Palantir: A Rigorous Exploration Of A Modern Tech Leader

Thesis

Palantir Technologies has been one of the most speculated upon software companies. Often dismissed as a “meme stock” by Wall Street,1 yet with a cult-like following from many retail investors.2 While I understand that the genuine strength of the technology can be challenging to grasp and, therefore, invest in, this can be rectified with enough information. The purpose of this article is to provide holistic coverage of the entirety of the company. Including the business model’s unique lock-in effect, the technical moat offered by their software, their past media controversies, the relative strength of competitors, and, of course, coverage of their financials. By providing a high level of detail and sourcing every single claim made, I will give the readers a large amount of the due diligence material necessary to accurately assess the company.

In addition to standard investment research like financials, valuation, and competitors, this article will first provide significant detail on the technical capabilities of the product, with every single claim backed up with sources. Far too much of the current investment conversation around Palantir builds in unjustified assumptions, and without the ability to prove these claims, no additional value is added. This extends beyond other Seeking Alpha articles into many professional investment reports by experienced investors. Still, these reports amount to little more than hearsay without the subsequent justification for their future revenue predictions and competitive advantages. Anyone can make up technical moats or revenue figures to justify a valuation; the hard part is to base those numbers in reality, back it up with facts, and prove it to everyone.

Overview of Business

As the CEO Puts It: “[Palantir] is a very unique company, and the question of ‘how did you get this revenue growth from a late-stage tech company’ is a very interesting one. This happened because our business is just different than what you’ll find in most software businesses. Most software companies build software based upon what were the past needs of those clients, and they reduce those needs to a tiny, understandable wrench that you can buy and put into your Frankenstein monster of [enterprise software]. Palantir discovered in the [intelligence] and defense space that the single-most efficient way to supply software is to supply the whole stack. That the end user, to get the true alpha of the enterprise, needs a stack that works on day one, or in our case, hour two..” - Alex Karp, CEO of Palantir.3

Palantir Technologies was established in 2003, and the name is a light-hearted play upon the Lord of the Rings term “palantíri,” which were seeing stones.4 They started by using PayPal's visual threat-detection software and applying it in a military context,56 but soon they began to create more advanced software for small-scale military and intelligence cases. Over time, they generalized their product to work amongst various executive agencies, which also attracted much skepticism and conspiracy. Still, they have been purported to have caught high-profile targets such as Bobby Shmurda,7 Bernie Madoff,8 and Osama Bin Laden.59 Their presence has expanded across the world and to the commercial markets. They have supplied the Ukrainians with targeting software that increased their success rate by 2000%,6 distributed millions of vaccines and PPE safely,10 11 decreased PG&E wildfires by 99% in California,12 and permanently lowered BP’s cost of production by 57%.13

Above all, Palantir is mission-focused, and they pride themselves on delivering the best software to America’s most important service members and industry-leading companies. Since day one, they have been driven by a code of ethics that few other companies in the world rival.14 Namely, they view their continued work with the government as a civic responsibility to maintain the economic strength of the United States.615 Consequently, they have always, and will always, refuse to do business with countries or companies that work against American ideals.1416 They have never provided software to Russia or China, nor are they likely to work with many prominent social media companies since Alex Karp views them as “carcinogens” to society.617 They will not waver in their resolve on this matter, and encourage investors and employees who cannot be a part of a company like that, not to join.1418

Palantir is an exclusively business to business (B2B) company that focuses upon integrating organizations' entire data pool into a single layer of truth, which they call the “ontology.” Unlike a traditional SaaS company that solely provides the software, they offer customers the ability to hire Palantir’s Forward Deployed Engineers (FDEs) to ensure smooth, rapid deployment. In fact, Palantir can be implemented into companies in less than two hours.19 Many analysts have likened this to a consulting company; however, the FDEs are not a requirement, especially after initial deployment.6 Contrary to some analysts' understanding, FDEs leave after the integration.2021 Palantir is beginning to offer more modular products for smaller companies,22 and the use of FDEs acts as a subtle way to have customers subsidize a significant amount of internal research and development (R&D). Two products make up the vast majority of their current service offering: Gotham for government customers & Foundry for commercial customers. However, there are two other recently released products that are much smaller in use case, but with significant potential to scale over the years: Apollo, which distributes autonomous cloud updates, and the Artificial Intelligence Platform (AIP), which seamlessly deploys LLMs into organizations — notably, AIP appears to be growing quite rapidly.

At a macro-level, all of Palantir’s offerings strive towards one unified purpose: to make your business literally as adaptable as code.23 The three main technical advantages they hold over their competition are their unrivaled data governance, their ability to generalize code across complex, diverse environments, and their “ontology” layer that provides a single, transparent plane that can control and audit any lever in a business. Understanding these technical advantages is critical to all investors.

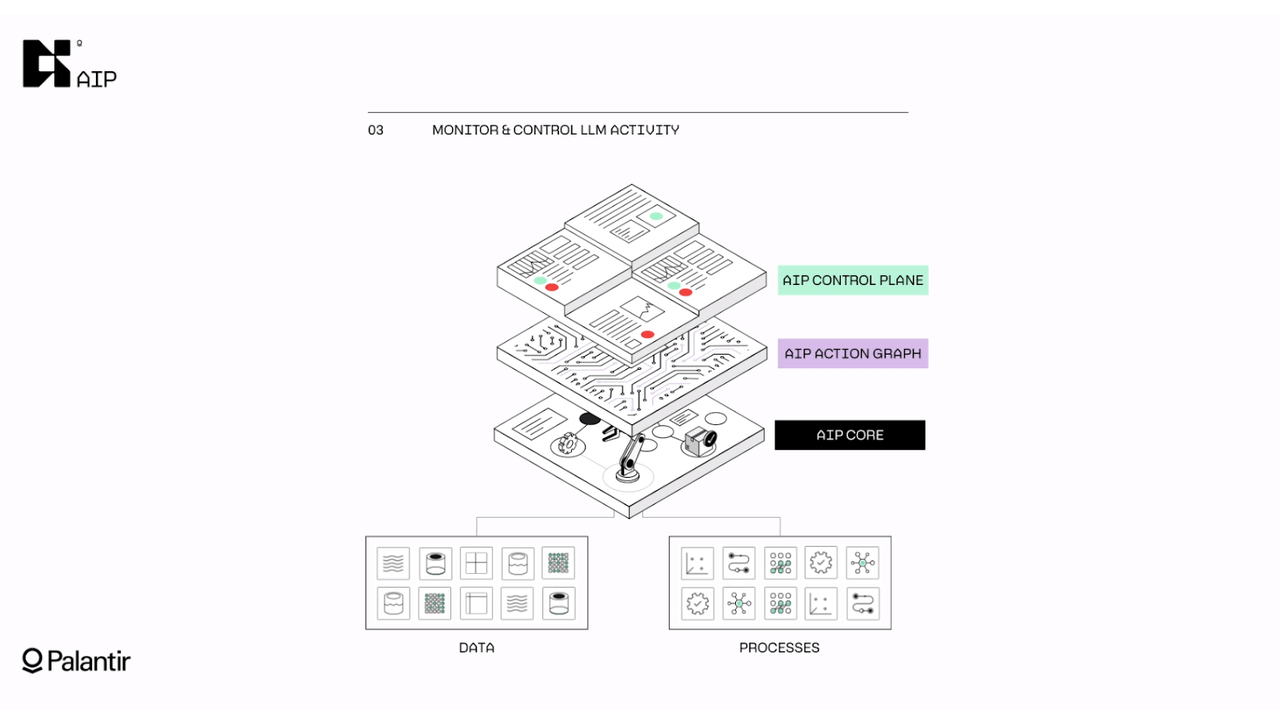

Let’s try to visualize a flow chart of their software stack:

At the absolute core of their architecture is one of the most robust data governance systems in the world. With a microscopic level of purpose based access controls and auditing software.

On top of this, a company’s data can be uploaded. Almost any type of data, structured or unstructured, and any third-party tools or warehouses, such as Snowflake or Databricks, are supported.

Then comes the “ontology” that connects these disparate data streams and uses proprietary software to organize it all in a structured way.

After this comes the analysis pane. Palantir is agnostic as to whether it is heuristic code, machine learning algorithms, or custom-built data science tools.

After analyzing data, the system can determine what future actions should be taken. These steps can be set up however the organization desires. Whether the system only provides an alert to human operators, takes semi-autonomous action (with hand-offs to humans for verification),24 or takes autonomous action is entirely customizable. This is where Foundry and Gotham’s capabilities end.

However, the recently released Artificial Intelligence Platform (AIP) can combine all of this functionality and incorporate it into a user interface (UI) that can be operated either partially or exclusively through natural language.

In reference to this photo, the data governance would be visualized as a foundational layer below all the layers here. Then, the data and institutional processes (laws, norms, ethics) go into the system, producing the AIP Core, aka the ontology. The AIP Action Graph is the subsequent layer that can autonomously make actions or hand-off certain actions to humans. Lastly, the AIP Control Plane allows the user to interact with all the previous layers through natural language.

The History of Palantir

Founded in 2003,25 this company has found itself covered in controversy. While loved by the select few who’ve used the products, it is mistrusted by the media,1626 adored by visionaries, despised among the titans of Silicon Valley, fantasticized by investors,2 and unknown to the general public.26 You can only comfortably invest in Palantir by first understanding the past controversies and then preparing for future ones. It is an incredibly divisive company, and, while I believe much of the criticism is overdone, I will not sugarcoat or hide pressing matters. Unfortunately, there’s no way to fully compress 20 years of history into a short segment of one article, so I’ll be addressing the key product launches, legal battles, and media coverage while providing numerous links for anyone interested in learning more.

2003-2008

During this time, Palantir was trying to establish its footing, just like any other dot-com start-up, except they were a couple years too late to get substantial funding from investors. This private market pressure is why they originally started working with the US government; the relative income stability made life much easier for this burgeoning start-up.6 This was also the time period where they developed and deployed their first system, called Palantir Government aka PG — which later turned into what is now called Gotham.4 However, woefully little information is available online about this early product or its triumphs and failures. One of the only tidbits of information I am aware of regarding this system is that Peter Thiel, one of Palantir’s co-founders, used to work at PayPal. While there, the team had developed an internal antivirus software that enabled them to visually see cybersecurity threats faster than other software algorithms at the time.627 He and Alex Karp joined forces to co-found Palantir, along with three others,4 and the company slowly adapted that PayPal technology into their PG system.

2008-2016

In 2008, Gotham, the first major product of Palantir, was launched.25 This product is the foundation of all other advancements they have made, and its role in determining the company’s culture and motivation cannot be understated. Gotham was a resounding success, and the Edward Snowden leaks only served to prove this. A classified document among intelligence officers mentioned Palantir. “The report described Palantir’s demo as ‘so significant’ that it warranted its own entry in GCHQ’s classified internal wiki, calling the software ‘extremely sophisticated and mature… We were very impressed. You need to see it to believe it.’” Additionally, there was another piece of context that demonstrates how Palantir was able to develop such amazing software: “Palantir is described as having been funded not only by In-Q-Tel, the CIA’s venture capital branch, but furthermore created ‘through [an] iterative collaboration between Palantir computer scientists and analysts from various intelligence agencies over the course of nearly three years.’ While it’s long been known that Palantir got on its feet with the intelligence community’s money, it has not been previously reported that the intelligence community actually helped build the software.”27

The second quote brings up another notable point of Gotham and one that many detractors will surely point out: it was “CIA-backed.” Like most things, this is partially true, but not the complete picture. The CIA has a small venture capital arm called In-Q-Tel28 that helps to keep small companies with helpful military or intelligence technology afloat, and in turn, they might get their money back over time. Like any venture capital arm, the goal is to invest a small amount into many start-ups, hoping that a few end up growing into very successful companies. The CIA saw this as the perfect way to foster better government technology while also using very few taxpayer dollars since some companies, like Palantir, will grow to be quite successful and earn back magnitudes more than originally invested. The amount of funding provided by In-Q-Tel was 2 million dollars.29 While helpful, especially as a small company, it is a bit ridiculous to use this as a justification for calling the entire multi-billion dollar company “CIA backed.”

Obviously, incorporating a start-up culture of quick iteration with knowledgeable experts leads to dramatically better innovation over time. Furthermore, as a potential shareholder, the reader might be glad to hear that this has continued to be their strategy as they have grown. They use their FDEs while deploying their software in order to create systems that fit each customer’s needs. In doing so, they can take that knowledge and generalize the software to develop new auxiliary offerings. A quick scroll through their pre-packaged solutions page30 clearly demonstrates this system’s advantage: quicker deployment, happier customers, and less R&D spend. As Shyam Sankar put it, “the FDE model [is] one of our greatest secrets.”31

Another partnership that was started around this time and has generated a lot of controversy over the years has been their involvement with Immigration and Customs Enforcement (ICE) and Customs and Border Patrol (CBP). There are very valid criticisms of these departments’ actions and how Palantir has assisted them, yet there’s also been unfair criticism made by media channels that don’t grasp the complexity of the problem. For the sake of brevity, I won’t address all of the claims; however, two excellent sources for the other side can be found under sources 32 and 33.32 33

Palantir began working with ICE in 2018, and their relationship with CBP started around the same time.33 Most media companies seem to view working with these government departments as inherently bad; however, the Palantir management does not.34 The management, and therefore the company as a whole, believes that the American society has agreed upon these agencies existing, so it would be immoral to subvert the people’s will just because a minority of the population disagrees.15 Unfortunately, it seems like many media publications don’t agree, and this is a risk to Palantir’s public perception. To develop your own stance, the reader first must understand what is and isn’t being given to these departments.

Palantir’s software can be used to facilitate immoral or illegal actions, and it can help accomplish an enterprise’s/executive agency’s goal.35 However, Palantir’s software doesn’t automatically provide any of this — users set up the software in the manner they wish. Additionally, Palantir doesn’t sell or own any of an enterprise’s data363738 — all data in the system, except patented technology, is going to be user-owned or publicly sourced data. Lastly, Palantir’s software can show any and all actions taken on the system, so, if court battles arise about the user’s actions, they can demonstrate who, what, when, where, and how.39 I struggle to see how Palantir providing access to their software license is any different than Microsoft selling Windows OS to these agencies. Yes, it can help them with their jobs, but that is not a fair criticism towards the company, it should be directed towards the agency itself.

The controversies with these two agencies have arisen from the ability to find illegal immigrants very effectively, and I’m not exactly sure where the legal or moral line should be drawn. Unfortunately, neither is Congress, so there are very few laws and/or regulations around it. This must be developed more, and Alex Karp has encouraged much more oversight in this realm.15 Their products continue to have the highest level of data governance, and their current stance is that they will follow all regulations as they get rolled out over the years.

While Palantir only really talks about the Gotham product during 2008-2016, during the early 2010s they began experimenting with generalizing their services to commercial customers.40 At first, this was mainly related to anti-money laundering and uncovering other financial crimes, like those of Bernie Madoff.8 However, this shift to commercial has only accelerated since these initial case studies.

Before diving into the more recent controversies, I want to address the bias towards bad news coverage that Palantir will always have. Palantir works with many governments and large companies who have confidential information or NDAs in place. Compounding this factor with them being a private company for almost 20 years meant that most of their work flew under the radar, especially the positive aspects.36 Until they became a public company, there was no one advocating for them, but this shouldn’t underscore the incredible work that the Palantirians (employees at Palantir) put in.36 There are countless benefits that will never be publicized such as the lives of those who were saved from terrorist attacks that never happened;6 enemies and tanks that Palantir located in Ukraine;41 hospital beds that were cleared up;42 vaccines that actually got to the remote rural towns,43 and much more. This will not end up being sensational and published in a big-time newspaper, but it is small improvements in entire industries that change everyone’s lives for the better; not the “groundbreaking” and luxurious new accessories for the top 10%.

2016-Present Day

In 2016, Foundry was launched.25 This represents the pinnacle of more than a decade of collaboration with the US Government, coupled with the application of insights from the aforementioned commercial clients. This was not a perfect product and there were growing pains, unfortunately, and this led to some big-name customers being unhappy. They had customers like Coca-Cola, American Express, and Nasdaq drop their offerings.44 Evidently, this was far from ideal, and at the time it brought forth serious questions about their commercial product offering and pricing strategy.1545 If these types of events continued through the years and into the present day, investors would be warranted in being extremely concerned; however, this has not at all happened, and over the following years the commercial customer count, especially in the US, has grown rapidly, often above 50%.46 Current US commercial count growth rate stands at 35% year-over-year, though it appears that AIP will re-accelerate this figure in the near future.4748

This is highly impressive for any company, much less one that is 20 years old, and this touches on an idea that seems pervasive across many of the most successful businesses in the world. Companies like Apple, Amazon, and NVIDIA constantly demonstrate the ability to strengthen their offerings and continue rapid growth even after decades of work. In fact, this might be one of the clearest indicators of truly exceptional businesses. For the recap of their remaining controversies up to the present day, I’ll address only the most intense disputes that Palantir has been involved in, with the understanding that this summary will not be fully comprehensive. These include parties such as the United States Army, the New York Police Department (NYPD), the United Kingdom National Health Service (NHS), and Google through Project Maven.

The first major event that does a phenomenal job highlighting the strength of their product versus in-house built software solutions was Palantir’s decision to sue the United States Army. It’s often said that they sued the US Army to use their product and won, but this is not the full context.4950 While that was the end result, the actual lawsuit was more general. The Army kept spending billions of taxpayer dollars to build in-house solutions when commercial options already existed for much cheaper, in violation of Title 10 §2377 in the United States Code for the Armed Forces.515253 The court agreed that it was ridiculous to spend $6 billion of taxpayer’s money on a product that was already commercially available.5 While proving in court that the internally developed system wasn’t as strong of an offering as Palantir’s solution, some very interesting information was revealed. Commanders in the 82nd Air Force division as well as on-the-ground operators continuously fought for the continued usage of the system, which has been labeled an “IED Buster” because it was so much better than the other solutions.54 A survey found that 96% of soldiers preferred Palantir over the internally developed system.5 This type of loyalty from the end users of the product, as well as the court stepping in to advocate for it’s purchase, is a very telling sign that Palantir can actually generate significant real-world value.

The second pressing issue for Palantir, and a debate that is only likely to grow stronger over the years, is their involvement in predictive policing algorithms. These are obviously very controversial and raise serious questions about where probable cause starts, but there’s no way to get through that whole debate in this article. An attached report from a US Air Force official does a nice job reporting on the ethical concerns of these efforts in the government.55 Additionally, a human right’s activist asked Alex Karp about this at a public discussion in Munich. His answer was phenomenal, and I’d encourage readers to listen to the entire 10 minute question and answer, which can be found under source 56.56 While the law remains unclear in this regard, the key takeaway for Palantir shareholders should be how transparent the data privacy standards are and how ingrained they are into Palantir’s software;57 this level of insight and segmentation gives me peace of mind that even if certain police departments do end up infringing upon citizens’ rights while this is still a legal gray area, Palantir’s software will be able to provide a clear understanding during court proceedings.39 In regards to the specifics of these departments, the New Orleans Police Department58 and the Los Angeles Police Department8 both currently use Palantir; however, the NYPD eventually stopped due to public pressure.7 Unfortunately, this was not an amicable separation between the two parties and they fought on numerous contentious issues.

Originally, the NYPD just wanted to leave the contract, and there was no issue there.7 Many of Palantir’s contracts have “terminate at convenience” clauses in them,59 and this appeared to be no different. However, when the NYPD wanted to transfer the data AND the analysis to another system, they ran into a problem. While you can transfer the data, you can’t transfer the analysis from Palantir’s software into another system. Since doing so would mean exposing the patented algorithms that actually transform that data into usable insights.7 The NYPD filed a motion claiming that this was like locking up money in a safe with a bank, but when you asked for the money back the bank would only give you the safe but not the key. I see it as getting your money back, but not being able to take the bank’s security systems and safety deposit boxes with you. As far as I can tell, nothing more came of this, so it appears that the parties settled the dispute out of court. But this does raise a concern for investors that this legal question will need to be answered in court sometime in the future, and, if the ruling goes against Palantir, it could remove some important aspects of their technological moat.

The next controversy that garnered significant media attention and criticism starts with Google. There were massive protests that erupted within Google in 2018 around their involvement in Project Maven.60 This project was with the DoD and it involved using AI to better target drone systems and other autonomous weapons systems.60 Many employees in the company felt this strayed away from their motto “don’t be evil,” and Google soon dropped the contract in order to satisfy their disgruntled employee force.60 Following this decision, Palantir bid on the contract and won.61 This immediately led to pushback against their decision from many of the same individuals who criticized Google.6162 Some of the most common arguments against taking this bid is that Palantir (and Google if they’d accepted) would be generating analysis in order “to identify human targets for lethal missile shots.”60 61

Obviously, Palantir’s management wholeheartedly disagreed with this mentality, and they have stood behind the decision and criticized other companies for backing down.27 In their view, it is a disgrace for a company to benefit from all the wonders of a safe and protected liberal society, yet also be unwilling to use the products they built in said society to defend the country that provided so much.27 The effects of Project Maven have not been directly mentioned; however, Alex Karp has mentioned that Ukrainians have increased their targeting effectiveness by a factor of 20 after installing Palantir’s systems.63 This is almost certainly the work of Palantir’s Gotham software, which has gotten better over time as tasks like Project Maven become more necessary for the modern battlefield. Accepting government contracts like these is not a stance that the company will waver on,6465 so investors must be comfortable with Palantir taking these contracts. However, it is important to understand they will hold some level of ethical limit. When asked by Forbes in 2017 if they would be willing to build the Muslim database that Trump wanted, the answer from Alex Karp was “if we were asked, we wouldn't do it.”66

Lastly, a major ongoing dispute regarding Palantir has been centered around a contract that is soon to be awarded by the NHS. This contract’s goal is to revamp the entire nationalized health service in order to make it significantly more modernized and efficient, and it is valued at over $600 million, with two 12 month extension options each worth $150 million.6768 There has been major political outcry, especially from a group called Open Democracy,69 because Palantir is seen as a “spy company,” and due to the perception that Palantir will be stealing and/or selling their data. These concerns around data privacy are valid to have, but there has not been nearly enough unbiased research into this topic by media companies. Many of the claims brought forth by Open Democracy in their exposé against Palantir70 appear to be unsupported.63 I will repeat this because it is crucial to understand: Palantir does not sell or train their software with customers’ data.57 In fact, Palantir does not have access to this data.71

There are three very promising signs that Palantir will be the successful bidder on this contract. Primarily, NHS England has ordered all hospitals to begin loading all patient data into Palantir;72 to me, this signifies their desire to begin integrating all of the complex workflows. This is encouraged by a recent $35 million contract by the NHS for Palantir to transition all of their current projects to the federated data platform.73 Lastly, a major consortium of three companies who banded together in February74 have recently announced that they were “unsuccessful” in their bid for the $600 million contract.75 This seems to paint a pretty clear picture of what company is most likely to be awarded the contract in late 2023, when the decision will be made.

In-Depth: Products

Intro

Like mentioned previously, there are four main offerings that Palantir now provides to customers: Gotham, Foundry, Apollo, and AIP.76 I gave the reader a brief description of AIP earlier in the article, but the goal of this section is to provide the reader enough knowledge about what is and isn’t provided so that they can semi-confidently predict future developments in the tool set. In order to truly understand the capabilities of the system, there’s going to be 10-15 minutes of videos from the company attached. While not necessary, I strongly recommend actually seeing the capabilities I’m referring to rather than purely trying to conceptualize these systems.

The first thing to understand is Foundry and Apollo are the core frameworks for all of their offerings. Gotham was developed first,25 but this doesn’t paint the complete picture. According to a recent technical interview with Shyam Sankar, CTO, on Stratechery, Gotham is much closer to being a special type of Foundry instance, rather than being a distinct product.31 76 Additionally, Apollo runs underneath all Foundry and Gotham instances,76 so any customer purchasing Foundry or Gotham is also using Apollo to manage all data security necessities and over-the-air updates.31 Apollo is the baseline architecture for all system governance, and Foundry is the absolute core of the ontology.31 Foundry has a modularity to its setup that allows it to be customized for various industries such as waste water treatment plants, gas and oil companies, or government entities. Gotham is the full suite of Apollo and Foundry but with a specific UI that is tailored to best suit government clients.31 76 Palantir began to realize that this data management need wasn’t exclusive to governments, so in 2016 they generalized their Gotham software into a break-away product, Foundry,25 which is their commercial offering that is similar in structure to the government offering, but with a customizable UI to allow any organization to use it.31 767778

As the reader learns more about Palantir’s core offerings, the key concept to keep in mind is the rapid and robust generalizability of Palantir’s solutions. It is the previously mentioned layer of data security at the core of their platforms, combined with sophisticated technological considerations like their choice to utilize a Kubernetes-based software stack,798081 that gives them this agility and scalability. I’ll demonstrate this in many examples throughout, and keep everything at a level that relatively non-technical readers can understand.

I’d also like to point readers to the aforementioned Stratechery interview with Shyam Sankar, CTO, and Ted Mabrey, Head of Global Commercial. This was the single best reference document I have come across during my research, and it helped clarify an immense number of points for me. I’m astounded by how little the retail community has covered this interview. I’d encourage any reader who doesn’t fully understand Palantir by the end of this article to read this interview. The link can be found under source 31 or at this link: https://stratechery.com/2023/an-interview-with-palantir-cto-shyam-sankar-and-head-of-global-commercial-ted-mabrey/

Apollo and Security

Since the foundation of the company, it has incorporated data governance into its software’s foundational architecture,57 and it has prioritized this above all else in the technology.17 76 This decision was disadvantageous for them while they were building their technology because it inherently added more complexity to the system and delayed the speed at which they could innovate.82 Not just that, fundamentally integrating this technology was extremely difficult at this time because no one had done what they were doing.8283 The main driving force behind this decision was the CEO, Alex Karp, who has a PhD in philosophy.8485 He believed that in order to scale this system and make it durable over the coming decades of software development you needed to start with security, not throw it on at the end like most companies do;17 83 8586 a phenomenal example of management being willing to sacrifice short-term gain because of their long-term focus.14 They have highlighted this focus in their S-1 filing with the SEC,16 and this is a quality that I, personally, demand in my investments.

This choice has enabled them to have the highest internet security ranking possible in the DoD — Impact Level 6 (IL-6) as well as many other standards like GDPR and HIPPA.87 Currently only two other companies in the entire world have proven the capabilities to manage data in compliance with IL-6,88 and both have market capitalizations of over a trillion dollars… Alex Karp has repeatedly stated that just about all data regulation is beneficial for them because they are by-default better equipped to handle it than their competition37899091 This is an extremely interesting point and gets to the heart of Palantir’s competitive moat. Often, Palantir is the only bidder on contracts, and that is largely because of their immense data security focus at the beginning of the company.6 63

One interesting product they recently released is FedStart;92 this offering allows other companies, including ones integrating LLMs,93 to instantly get access to DoD IL-5 certification and FedRAMP approval.93 The only requirement is that the company containerize their software so that it can run in a dedicated Palantir environment.93 This is significantly easier than the standard process, which requires securing an agency sponsor, ~$1 million in auditing fees, 18 months — on average — to build the software infrastructure, and recurring costs of separate GovCloud infrastructure, monitoring, and compliance checks.93 Palantir is actually so confident in their software that they will be responsible for backing these companies’ Authorization To Operate (ATO) conversations, compliance artifacts, continuous monitoring, and control assessments, which will cover just about all security concerns for a company’s government deployed software.93

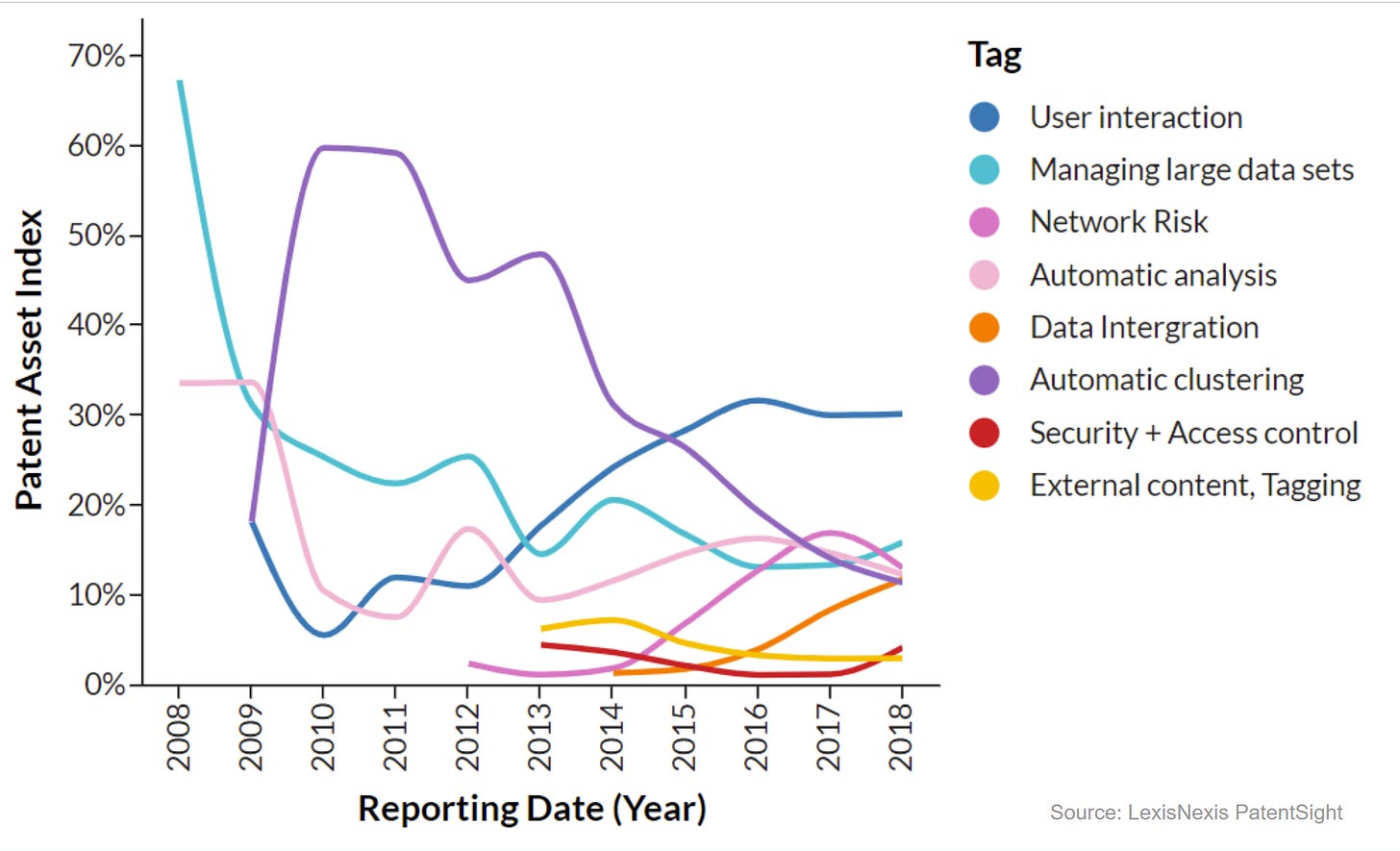

Their strength is also indirectly supported through their patents. Extremely valuable data was done on their patent quality and quantity in 2018 by the company LexisNexis through their product PatentSight.9495 While 2018 might seem like a long time ago, in the grand scheme of the company, this data represents where it stood after 75% of its time operating.

Interestingly, you can see that certain categories of patents surmised ~70% of their patent focus; however, I reached out to LexisNexis and they clarified that this is because only 3 patents were available then. They also updated these charts for me, which will be highlighted later, but it's still intriguing to see where they stood after Apollo, Foundry, and Gotham were developed.

Apollo was originally created internally for Palantir to be able to meet the DoD IL-5 and IL-6 standards and in order to help them deploy software updates across their fleet.88 Soon, they realized just how massive of an unmet need this was in the marketplace, so they rapidly began to make a distinct product out of it. One unfortunate downside of trying to excite investors about Apollo is that it sounds very easy to explain what it does, but it’s actually an incredibly complicated software engineering task to get done. It’s a case where something is much easier said than done.

Fundamentally, Apollo is a system to autonomously deploy updates across devices in an organization and to provide auditable data governance.88 I’ve addressed the data governance aspect, but autonomous deployment is highly complex as well.57 76 88 Different devices ranging from systems installed in the 1940s all the way to cutting-edge technology need to be managed. To get to the root of the problem and business case, writing software has always been incredibly slow. Most software engineers spend the majority of their time writing infrastructurous code to connect various tools and databases rather than writing meaningful code. And of the “meaningful” code that they do write, a significant amount of time must also be spent debugging it as well. This might mean that only 10-20% of an engineer’s time is spent on truly transformative code.

Imagine the tech team for a large public school system has found an urgent virus in the system and they need to push out an update across their fleet of devices. They might have Smart Boards, desktops, laptops, cell phones, printers, Chromebooks, etc. in their fleet, and, life’s not perfect, each of those devices likely have various different versions, such as IOS 15, 16, and 17. Now take those challenges and realize that’s likely a group close to 10,000 users who all need the updates to go off without a hitch. You can’t allow the systems to shut down. Hopefully this is starting to give you a sense of the scale of this challenge. Now imagine doing this with a product that you want to offer across the globe and to multiple government agencies…

Rather wasting engineers’ time on custom-built solutions that fail to deliver any return on investment (ROI) 90% of the time,96 spending millions of dollars, and waiting years for any hope of success, a company could outsource these pain-points to Palantir’s Apollo. There’s been very little information released by Palantir on customer adoption of Apollo specifically; however, it is worth noting that any organization that buys Foundry or Gotham is also going to be using the Apollo system for production infrastructure.31 76

One very interesting development within the past few months involved Cisco, which recently adopted Apollo as a stand-alone product in order to manage all of these various tasks automatically.97 Of all the companies to outsource this, it might seem odd that such a well-established tech behemoth would be the first company to publicly announce their purchase of the Apollo system. Yet, digging a little deeper, it makes perfect sense. They have enough technical expertise to accurately grasp the complexity of the problem, and are therefore much more likely to throw in the towel before ever stepping into the ring.6

Gotham

There is a 6 minute video from Palantir demonstrating their Gotham technology that is incredibly helpful at visualizing how smooth and integrated various disparate data systems can be and I’d suggest watching it to provide context to what I describe. The link can be found under source 98 or at this link: https://youtu.be/rxKghrZU5w8.

Fundamentally, Gotham is a way for massive governments/government entities to securely store, organize, and analyze their data.98 Like anything from Palantir, at the heart of the platform are the rigorous safety standards, like their purpose based access controls (PBACs).57 This enables them to build complex chains of custody and a federated platform that gives every user individual-based security controls, extremely helpful for disseminating information that is on a need-to-know-basis.57 71

On top of this layer of their software stack is an intake layer that is often referred to as an ontology. This level of the software stack is data-agnostic towards what type of data is being delivered to the system,63 whether that be various LLMs, a Snowflake database, AWS server, edge data that isn’t routinely connected to the system, or public data sets/devices.77 7899 From there, Palantir is able to organize, label, and visualize all of these disparate data streams.77 78 99 This process is the “magic” of their software, and is patented technology that they obviously won’t reveal. After this is done, they build a digital twin of the client company.77 78 One where every user, according to their security standards,57 78 has access to live data of their operations and the ability to send real-time over-the-air requests to these systems.77 78 99 Additionally, they can model real-world systems to run thousands of simulations against.77 78100 Whether this be used by Scuderia Ferrari creating the best race car,101 PG&E modeling their entire California ecosystem to find the most vulnerable components,10 or modeling and adjusting specific valves in a water drainage system in preparation for a storm arriving soon.102

Lastly, there is an action layer that operates on top of this. This is where all of that previous work can finally be realized. You can build automated tasks and AI systems, run analysis to find trends, make models to help predict future actions, or simply just manage your local production facility in real time.78 This relatively small layer on top is actually what the majority of users will deal with, and it’s expansive enough of a UI that it can be used for a broad range of skills, from sophisticated data science and machine learning algorithms all the way down to low-code no-code use cases that have real-time intake and output data of an operation.78 101

There is one feature that Palantir originally developed for the government that needs to be briefly highlighted. MetaConstellation103 is a product that allows satellites to do amazing things like track submarines using slight changes in ocean color gradients104 or detect mortar shots using slight changes in temperatures from weather satellites.41 Recently they’ve expanded it to the public sector to autonomously scan solar panel fields for panels that aren’t swiveling correctly to follow the sun.105 This perfectly exemplifies how Palantir’s work on complex problems with governments can then be quickly transferred into solutions for the private sector, though vice versa is obviously possible.

Foundry

This is very similar to Gotham, so I won’t waste too much time in this segment. This product is roughly the same as Gotham, except it is for commercial customers.76 They incorporate the same security measures at the core of the architecture, then comes the ontological layer of the architecture, and, lastly, comes the action plane.76 Rather than having the government-specific action plane for users, Foundry is more customized to each industry and company’s specific use-case.99

One interesting thing to note about Palantir’s approach with commercial customers is their acquire, expand, and scale method106 107 that they utilize in order to entrench themselves in the foundation of a company. This method is the main motivation behind Alex Karp saying that they have “no pricing strategy for AIP.” Their intention is to “take the whole market” and deal with pricing after customers realize the value it can provide.63 Alex Karp phenomenally elaborates upon this in an interview with Bloomberg. This can be found under source 63 or at this link: https://youtu.be/DcGkfF09QS0. Their approach to customer acquisition is why I value customer count more than revenue growth in the short-run. Future profits, even when discounted properly, are more valuable to me because of how small the current scale is as compared to the amount of impact (and subsequent profit) they could have in the future.106 To give an idea of just how transformational Palantir is, here are some quick case studies:

It has permanently lowered BP’s cost of production by 57%.13108

Decreased PG&E caused wildfire damages in California by 99% in one year.12

Tysons Food saved $200 million in two years after spending an original $6 million for the software.109

Jacobs Solutions found ways to reduce costs at their sites by $90,000,000 in one use case alone — needless to say, they are rapidly implementing this.110

Tampa General Hospital saw a 28% reduction in patient hold time and an 83% reduction in time spent by nurses managing patient placement.42

Below is a helpful visual of the live data lineage visualization Palantir offers in all four of their products. This is what it means when Karp says they are easily auditable. The entire 8 minute video that this is pulled from is linked below and is a phenomenal showcase of their recent AIP demo. The picture can only do so much. Readers should watch this 8 minute video, which can also be found under source 111: https://youtu.be/XEM5qz__HOU. As a fun sidenote, I believe this is the modern iteration of what can be considered the genesis of the entire company - the now archaic PayPal data visualization tool.85

Artificial Intelligence Platform (AIP)

The software stack I visualized at the beginning of the article is an example of AIP integrated into a Foundry or Gotham instance, and this is a capability that no other company in the world has. In fact, most are 3-5 years away.63 83 The earlier linked video in the Foundry section also has an amazing demonstration of this product.111 One highly intriguing potential that Alex Karp and Shyam Sakar have repeatedly hinted at is AIP’s ability to gather highly accurate responses, without much, if any, hallucination problems. Currently, this remains one of the most pressing issues in all of LLM research,112 so if Palantir has found a way to mitigate and/or solve the hallucination problem, it would be a profound technical moat of their product.

Expressions frequently made by Alex Karp that AIP “doesn’t write poetry,”63 and Shyam Sankar repeatedly stating that AIP writes “profits, not poems”113114 alludes at what I’m about to describe. In the course of writing this article, I had taken a break and listened to a podcast by Lex Fridman with Joscha Bach to relax.115 Joscha Bach is a famous AI researcher who did research at MIT and Harvard, and, until recently, was Principal AI Engineer at Intel Labs Cognitive Computing group.116 From 1:15:30 through 1:18:38,115 he mentions a theoretical method on how to make an LLM “coherent,” and he says that he sees no technical barriers to doing this. He talks about doing so through using a multitude of LLMs that are segmented according to certain standards, and using what amounts to hand-off functions to separate these layers. Additionally, he says that doing so would require a different architecture for the data than is currently used. This is exactly what Palantir’s ontology is and does.83117

AIP’s front-facing use goes on top of the ontology and action layers, and it is essentially an extremely sophisticated UI to enable non-technical users to better interact with the rest of the Palantir software stack.76 This is also what I demonstrated in the beginning of the article with the software stack visualization. Furthermore, Shyam Sankar has recently done two technical interviews and one earnings call where he elaborated upon the technical work going on behind AIP.31 76 For most modern companies, they are integrating a statistics-based framework yet, at present, trying to deliver one single “correct” answer.76 Palantir on the other hand uses a multitude of LLMs in order to get consensus from the “stochastic genies” that are LLMs.76118 He has mentioned the technical framework behind this being a K-LLM-Kernel that they use to get responses from any number of LLMs.118 More information about this will be coming at AIPCon 2.118

They were able to produce this LLM capability within a couple months of the ChatGPT launch, and this product seems to strengthen Alex Karp’s point that data security regulation is beneficial to Palantir.76 Combining highly unreliable “stochastic genies'' with the world’s most sensitive data, is extremely difficult. Palantir’s decision to spend a vast amount of time building security standards at the base-level of their software stack is similar to how one might need to spend the majority of their time on the foundation of a house. Once the framework is done, adding an additional appliance here and there is relatively simple. In order to develop LLM capabilities in a way that can be secure for the most important systems, whether in commercial or government, data governance has to be center-stage.

AIP already has both a defense and commercial offering, and they’ve begun to integrate the technology quite successfully with their long-standing customers. It appears Palantir began their AIP development by working with trusted partners like Jacobs Engineering, and at least 5-6 others, in order to iron out the system before full-scale release.31 102 However, they are already offering this capability to a much larger audience. Alex Karp recently stated that demand for AIP caused them to receive more inbound in one month than they have previously gotten in an entire year.63 In addition, the company has offered personalized demos to interested users every week for the past 6 weeks.119120 AIP’s proven performance in released videos and customer demonstration, combined with the seemingly industry-leading ability to mitigate hallucinations, paints an exceptional picture of AIP’s success. As a further point, metrics recently released about customer demand are stunning. 400 customers are in talks to use or are currently using the product, within 3 months of release.48 This is extremely promising, but it is noteworthy that they still need to finalize 300 of those deals, and customer count still needs to be translated into revenue growth and profit. At present, there remains too many unknowns to confidently predict its future success.

As a fun side note, Palantir garnered quite the notoriety on Twitter a couple months ago when Elon Musk responded to an AIP demonstration and insinuated that he was both impressed but concerned with these advancements.121 The Twitter thread in question is here or under source 121: Tweet w/ Elon Reply.

Future Products

There has been little said by Palantir about future products; however, there is one product that has largely flown under the radar that I am extremely excited about. While this is largely speculation, it is my belief that this one product alone could be the single greatest under-reported event by Palantir. The product is called Foundry Marketplace.122

My intrigue in this all started from a recent Washington Post article about Palantir’s role in Ukraine.41 There was a line in there that didn’t fit with my previous framework of Palantir: “by the end of the war, [Ukraine] will be selling software to Palantir.”41 I’d thought that Palantir only sold software to other companies and governments, so there was no need to buy back this software as well. However, a change of one word revolutionized what I thought about Palantir's future. If you read this as “selling software through Palantir,” and incorporate what I’m about to describe of the Foundry Marketplace, you begin to see a picture of a B2B App Store platform, one for entire data products.

To understand this, the reader must first be made aware of what Palantir calls “data products'' or “Foundry Templates.” This could be something like a hospital’s entire framework for managing patient and nurse scheduling, as pictured above in Palantir’s own videos about the Foundry Marketplace. Palantir has the ability to package all of the infrastructurous code related to a given product, and distribute this across any organization that also runs Palantir. A fantastic semi-technical explanation and demonstration of this can be found in a video from a popular Palantir YouTuber named Codestrap; in fact, he was given access to Foundry in order to bring more attention to the system. The video can be found here and under source 123: https://youtu.be/OsmBRDx7SQI. To quote the beginning of the video linked: “To me, [Foundry Templates] makes [Palantir’s] entire go to market strategy make a hell of a lot more sense. The network effects for people building these templates for existing Foundry customers will be massive, and it could support the next generation of start-ups, built on Foundry.”123

As Codestrap mentions in the video, this seems like the next generation of APIs.123 Rather than needing to connect a bunch of these REST APIs into a Frankenstein back-end, one could imagine just pointing a purchased Foundry Template towards actual production data and seamlessly having the back-end handled by Palantir’s internal software.

In reference to Ukraine, one could also imagine packaging drone targeting systems, or other related products, and selling this back to countries that provided support to Ukraine. As far as I can tell, there appears to be no technical limitation behind government use cases. Many months ago I briefly talked to Dorian Smiley, aka Codestrap, about this on his Discord server, and he agreed with me. Unfortunately, I cannot find these messages, so readers will have to take me at my word on this government application of Foundry Templates.

Either way, the commercial application of this alone could be a multi-hundred billion dollar industry. A company like Supercell could sell a framework for building mobile apps that any burgeoning start-up could purchase. This would come with all of the technical necessities such as in-game physics, A/B testing, and cloud-based user profiles that would be a requirement to make high-quality mobile applications. In fact, just about any company across any industry could package and sell these frameworks to other companies within the Foundry ecosystem. This could be one of the greatest customer lock-in effects ever seen by B2B software, highly reminiscent of the Apple approach to their ecosystem and App Store. Similar to the App Store as well, one could imagine Palantir taking a significant cut since there are no other companies in the world that offer these capabilities.124

Market Analysis and Competitive Offerings

I cannot possibly spend the time doing this same level of analysis to every company in the space; however, in order to get a better understanding of the competitive landscape, we can look at various analyses by third-party companies. While not perfect, software is unlikely to be completely zero sum; Palantir can succeed while other companies do as well.

The first report, of many, is from Forbes in their Forrester Wave AI/ML Platform Q3 2022 Analysis. In it, the authors placed Palantir as one of the strongest current offerings. Additionally, it was placed as having a healthy amount of market presence — within the top five. The visual can be found in Palantir’s SEC registered presentation deck for Q1 ‘23. The link can be found under source 46 or at this link: https://investors.palantir.com/files/Palantir%20Q1%202023%20Business%20Update.pdf.

When I reached out to Forrester, they denied permission to actually include the visual of it. For the reader’s sake, I’ve provided a link to Palantir's public SEC filings. Additionally, Forrester didn’t want me to include links to the full report that is on their website. I will politely oblige. Though, I think it is notable to mention that C3.ai has a press release about Forrester’s report, and in it there is a link to a free reprint of the entire report. Individuals can access that themselves if they are so inclined. Taking the information in the Forrester graphic and report, and viewing it in conjunction with my earlier documentation of their technical prowess paints a very positive view of Palantir’s market strength. One which only makes sense considering how much proof was previously provided of the product’s superiority and capabilities.

The IDC is another neutral reviewer, and they had previously found46125 that Palantir had the greatest amount of revenue and market share in AI software sales of any company. However, when I reached out to IDC to ask permission to use a graph from their report, they informed me that an updated version was published in July.126 In this updated version, Microsoft has surpassed Palantir in AI market share and revenue, so the earlier claim is no longer accurate. They provided me with the updated numbers, and I have created a graphic to help visualize this data. I have received permission by IDC to include this data. Any and all statements made in this article do not represent the opinions of IDC. I created the visual using the data provided by IDC.

Another notable industry standard for viewing product strength is the Gartner Magic Quadrant. Unfortunately, Gartner has very few Magic Quadrants that include Palantir; however, one for Data Integration Tools does include Palantir, and it placed Palantir as a visionary.127128129 The ranking in completeness of vision was in the top five; however, on the scale of ability to execute, their ranking was about middle of the pack, roughly in-line with AWS.128 The magic quadrant is pictured in a tweet under source 128. The full report is under source 129 or at this link: https://www.gartner.com/en/documents/4017726. Any and all statements made in this article do not represent the opinions of Gartner. An additional metric that can be useful are the product reviews on Gartner, which are pictured below.

Reviewers must be verified business owners, there can’t be floods of unfair reviews. Considering this context, the product reviews on Gartner, for Palantir’s service, seem strikingly positive. Their ranking is higher than that of AWS and Microsoft, and the distribution of five star reviews versus four star reviews is significantly higher than these two competitors. I’d encourage readers to visit the page themselves and read the reviews.130

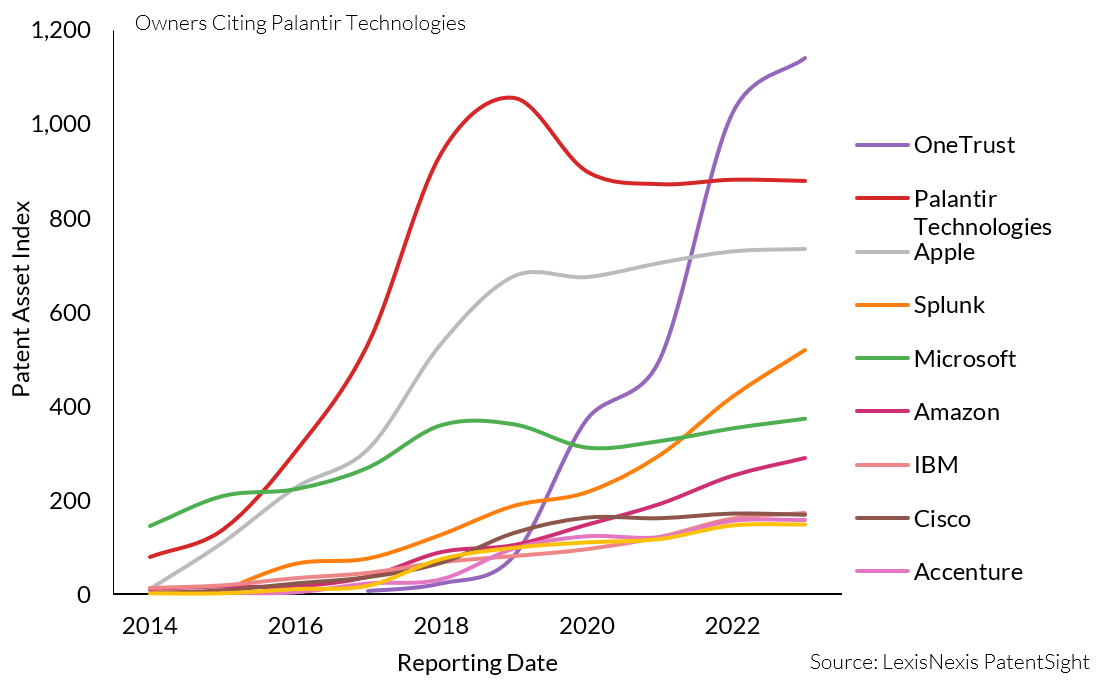

Lastly, The PatentSight analysis platform by LexisNexis, mentioned earlier,94 95 also provided a great deal of context into how Palantir’s technological sophistication stacks up against competitors. When I reached out to the company for permission to use the graphics, they were more than willing to let me do so. In fact, they offered to update all of the data to 2023 since the report was a bit old — 2018. This information has not been publicly released as of yet, and I’d be remiss not to include this, though it does not paint a picture of continued strength in Palantir’s patent portfolio. For the sake of fair journalism, I’ll include all of the data provided to me.

In this last graph especially, there is a slightly worrying development. A company called OneTrust131 appears to have skyrocketed their citation of Palantir’s patents, to a level higher than that used by Palantir themselves. I’m going to refrain from speculating about the potential implications of this and leave that to the readers.

It is important to keep in mind that patent asset strength is not the strongest source of information, and other pieces of data, like the three before, are more likely to be real-time indicators of the relative strength that Palantir’s offerings hold. That being said, patents are still highly important and point towards the future trajectory of product developments.

Future Competitive Risk

While there are many uncertainties about the future, the biggest threat that I believe Palantir faces will be from Microsoft. Or at least a company offering something similar to what Microsoft has consistently done in the past. That is, taking a great idea, like the offerings of Palantir, and building a new product that offers less functionality but with much greater ease of adoption. Shyam Sankar, CTO, has also hinted at this.31

Time and time again, Microsoft has seen flourishing new technologies and adopted similar products into their ecosystem. Microsoft Teams doing this with Zoom is a clear demonstration of this. Even though the product might not give customers the full functionality of the original idea, the massive distribution network Microsoft holds is unrivaled and poses a severe threat towards any burgeoning technology company.

Currently, there are no offerings that provide the entire software stack, an “operating system for the modern enterprise” as Shyam Sankar often calls it. The data security underlying this operation is also highly sophisticated and unlikely to be replaced anytime soon; however, this is a constant risk, especially while the network effects of Palantir are only beginning to emerge. Being first and/or best doesn’t necessarily mean being most successful, so investors must constantly look out for this.

Management Team

CEO

Alex Karp holds a B.A. from Haverford College, a J.D. from Stanford University, and a PhD in Philosophy from Frankfurt's Goethe University.132 After some time in academia, he began to feel that it was too “self-pleasuring,” and that individuals should eventually build upon the ideas that they develop in academia.133 He is a devout Democrat who has donated to Hillary Clinton, and, in a leaked company gathering, has denounced Donald Trump.134135 I’ve listened to just about every single Alex Karp interview and believe he has a unique and insightful view on many topics.

He openly admitted on an earnings call that he personally made a massive error in the past by not expanding to the commercial space earlier,136 which likely cost the company tens of billions in opportunity cost. I respect this humility and look for this quality in a leader. None of us are perfect, and I think various other standoffish decisions he has made, like insisting upon data security at the core of the platform,27 were great examples of thoughtful leadership. As a leader, he has demonstrated a desire to focus long term by generally only offering 5 year business predictions,6 114 narrowly focusing on product before massive distribution,17 using FDEs to enhance R&D,76 holding a $3.1 billion stockpile of cash,137 having no debt,137 running free cash flow positive,137 and setting up a $950 million credit facility yet never having drawn it.137 For any investment I make, I insist upon management having a long-term time horizon as that is also my investment horizon - and I believe it leads to more resilient growth over time. Such commitment to this cause, through words as well as through action, makes me comfortable with him as CEO.

Many have criticized him for being too philosophical, not enough of a businessman, and have proposed replacing him as CEO or focusing his role into a solely government role.138 I do not agree with removing him in favor of someone else. While I do think that in certain situations he should focus on talking more about the business, he has been getting coached, and I’ve noticed an improvement in the demeanor and directness of his answers in investment settings. Though I must concur that his recent monologue in the Q2 ‘23 earnings call139 was much too long-winded.

CTO (Previous COO)

Shyam Sankar graduated from Cornell and Stanford, with a degree in Electrical and Computer Engineering, and Management Science and Engineering, respectively.132 He was employee number 13, led Palantir as the COO for almost 17 years, and he was just recently moved into the CTO role.76 140 He recently spoke in front of Congress and advocated for smart regulations on data privacy, while making sure to let them know not to go easy on our safety since there’ll at least be one company who can handle the regulations - Palantir.141 142 He’s talked at FoundryCon and AIPCon, and he’s a decent presenter but a bit too technical for most people. I think that it makes more sense for him to be in the current role as CTO and for the company to eventually find someone else to fill the role of COO.

CFO

David Glazer is the Chief Financial Officer and Treasurer, and has been with the company since 2013. He holds a B.A. in History from Santa Clara University and a J.D. from Emory University School of Law.132

CRO & CLO

Ryan Taylor has been with the company since 2010. He currently serves as the Chief Revenue Officer and Chief Legal Officer. He holds a B.S. in Computer Science and an M.S. in Management Science & Engineering from Stanford University, and a J.D. from Harvard Law School.132

Peter Thiel

Peter Thiel is by far the most well-known and controversial figure in the company. He founded the company with four other individuals, including Alex Karp, in 2003. Thiel is Chairman of the Board, and holds a B.A. in Philosophy from Stanford University as well as a J.D. from Stanford Law School.143 Thiel holds political views that many people disagree with, including Alex Karp; however, the two are very much still friends, and both love to respectfully argue through ideas with each other. Infamously, Thiel has been an ardent backer of Trump, and many media companies will use this to discredit all of Palantir. It is true that Thiel has a role in the company, but he most certainly cannot make a decision without the agreement of many others at Palantir. And Alex Karp, on the other hand, appears to be the political opposite of Thiel. I’d suggest the reader look more into Peter Thiel on their own, and make a personal judgment on whether they feel comfortable investing in a company where he has a minority stake. His presence has and will continue to cause significant media backlash.

Stephen Cohen

Steven Cohen is one of the co-founders of Palantir and is the President and Secretary. He has also been a member of the Board of Directors since 2005. He holds a B.S. in Computer Science from Stanford University.132

Class F Shares

One important factor to keep in mind while investing in Palantir is that they have F Class shares for the founders.16 This means that they did not give voting power to shareholders when they had their direct public offer. While you still own a legal right to the assets of the company, you do not get the same ability to vote on decisions within the company.16 This is risky for investors because there is little that you can do to change the direction of the company; however, it can also be incredibly beneficial for shareholders. Not giving this right to shareholders enables the company to make moves that will pay off in the long-run.16 Alex Karp has mentioned this willingness to sacrifice short-term gain for a more durable competitive advantage in their very first shareholder event, Investor Day.

Financials, SEC Filings, and Valuation

There are many metrics by which to evaluate a company. I’ll be selectively choosing the metrics that I believe most accurately represent the business’s development and future potential. However, I’ll attach an Excel file with the financials all the way up to Q2 2023, 40+ financial metrics graphed, and an adjustable DCF model that investors can use to perform their own calculations. That is here: https://1drv.ms/x/s!AjQjspP3-kYvgXmm61n2iY8qfn0U?e=zJ8hub.

At a broad level, I believe that Palantir has the technical capability to fulfill a large amount of the AI enterprise software needs. Not just LLMs, but the associated data privacy and ontological mapping that will be required in the future. I have laid out these capabilities in the above sections, and, due to this, believe in Palantir’s dispersion through the modern enterprise software stack. This leaves but one question left, the financials and valuation.

From these beliefs, I will incorporate a couple assumptions into my DCF:

The AI and general software space is going to transform over the next decade into a major factor in every modern enterprise.

I am willing to give Palantir relatively durable growth and profit retainment over the next decade because of their product strength and relatively small size.

There will be a much slower rate of stock dilution than in the past.

The financial history of Palantir is unfortunately not very long. They went public in their 3rd quarter of 2020. This leaves us with 12 reported quarters in total. However, there is some comfort in the fact that they’ve existed as a company for over 20 years, as it shows the ability to grow in a financially healthy way. Just about half of their revenue comes from the government, which helps to provide stable growth over time; however, increases in spending and new client purchases can often be very unpredictable due to the nature of Congressional budget appropriations. This is likely to result in lumpy growth from the government. Importantly, though, commercial revenue and customer growth is outpacing the government, so it is likely that commercial revenue will become a much larger share of the overall revenue stream. They have also recently turned GAAP profitable in the past three quarters, and they forecast continued GAAP profitability for the foreseeable future.144 Many people, including the CEO, have mentioned that this would then give them eligibility for inclusion in the S&P 500.

I’d encourage everyone to look through their numbers themselves; however, here is a broad overview of the most important financial figures to help analyze Palantir’s financial health and growth:

Three billion dollars in cash and cash equivalents.

Consistent gross margin of ~80%.

Colossal stock dilution after DPO.

Rate of stock dilution dropped dramatically after the initial couple quarters (and is finally in line with competitors).

Net income has turned positive over the past three quarters, and operating income over the past two quarters.

Since coming to market, SG&A + R&D have stayed constant or declined while revenue and earnings have improved.

Growth in the past has consistently been ~30% per year, but has recently dropped.

US Commercial Customer Growth Rate, excluding SPAC investments, grew at 35% year-over-year.113

US Revenue, excluding SPAC investments, grew at 37% year-over-year.145

US Total Contract Value year-over-year is up 170%.145

50.5% CAGR in the US business over the past three years 10 months. ([(36*1.61)+(10*1.127)]/46=1.505)47146

AIP has significantly boosted demand. In less than three months, 100 customers have signed on, and they currently are in discussion with an additional 300 customers.48 If a large portion of those potential customers are retained, this could have an extreme impact on future customer count metrics.

While these numbers and the potential demand for AIP looks strong, the following are notable metrics that do not paint such a great picture:

Net revenue retention has fallen to 110%.

The Board has approved a one billion dollar stock buyback after the stock had run up 233% in the past 7 months (December 27, 2022 – August 1, 2023).

Revenue growth for FY23 will be only 16.12% higher than FY22.47147

The slowdown in revenue growth is worrying, though they have mentioned many times that their revenue does not come in consistently. Take 2017 for instance; they grew revenue 10%, but they view it as the single most important year for their company because of how much work they did on the Foundry Product.148 Additionally, their method of slowly expanding within commercial companies likely means that the revenue from customers will be delayed. You’ll need to track cohort data over time to better analyze this trend. Unfortunately, Palantir has stopped sharing this data with investors, though they used to do so. They have repeatedly obscured metrics that don’t look favorable to their business; common amongst most companies, yet a practice I will continuously scorn.

Net revenue retention in the recent Q2 Investor Presentation is a good example of diminishing the prominence of figures that are not favorable.47 Having revenue retention drop from 130% to 110% is another factor that could be worrying if it continues, but it could also be reflective of their efforts in product development and rapid deployment of their pilots. Still, net revenue retention at 110% still means customer expansion made up for roughly 60% of their business. This is a much lower percentage than in the past, and could hint at Palantir rapidly expanding the size of their new customer base.

The Board not approving a stock buyback program while the stock remained at prices well under $10 for almost a year, but then doing so after the stock had over tripled in price, is close to unacceptable without more commentary on the decision behind it. The best argument for their actions that I can see would be them saying this: it made more sense to first become consistently GAAP profitable so that Wall Street wouldn’t see it as Palantir trying to artificially manipulate the earnings per share (EPS) metric or being focused on the wrong thing — that is, stock price over operating profitability. While this could be a somewhat valid argument, there’s a couple holes in it. First and foremost, if they knew they could and would be operating profitably soon, it would’ve been even more advantageous to buy back a significant amount of stock. Secondly, even if they missed the opportunity to buy back shares while it was $6, buying at rich valuations remains an unjustifiable use of cash rather than focusing on internal business growth. According to them, the business is likely to compound at roughly 30% over the coming years; I highly doubt that stock bought at $18/share would compound faster than that. To be clear though, it is only an authorization to buyback shares. Management has discretion in determining if/when to buy. No matter what, without more answers on management’s view of the buyback, it is alarming to see such a large buyback announced after such a massive run-up in price.

For a long time while they were a private company, Palantir offered very generous stock based compensation (SBC), and this severely impacted all of their financials. Almost every metric that would include SBC shows the result of this. However, the management team has repeatedly stated that the dilution will “normalize” to the industry standard and become in-line with competitors,149 and this has been exactly what has happened.150 Because of the vesting time frame, I wouldn’t be surprised to see it slightly elevated for the next year or so, but it has dropped considerably and management reiterated on the Q4 2022 earnings call that it is coming down and staying down.151

This graph is from Blue Harbinger Investment Research. It uses data from Q1 2023, and I have been given permission to use this graph. The full report can be found under source 150 or at this link: https://www.blueharbinger.com/free-reports-1/DayofWeek/2023/6/21/this-ai-ml-stock-massive-sticky-secular-growth-jl92n.

In the past, management guided for 30% average revenue growth over the next 5 years.59 They have stopped reiterating this recently, and I think the reason for this is that macro factors have a chance of stretching out that time line enough to cause legal repercussions, even if it means it takes just 5.5 years instead. Recent statements from management about AIP’s customer growth and about their product’s overall strength make me quite confident in their long-run success.

The company has been able to steadily decrease their operating costs over the quarters, something which can and likely will be extremely beneficial to future profits. Their spend on these has fallen dramatically while revenue has doubled. I see no reason why they couldn’t keep this trend going because the marginal cost of adding another software customer is so much less than many other traditional businesses. Even with the FDE model, they can still apply previously discovered solutions to new customers in order to bring down deployment time.21

These numbers overall look very promising to me, and there really can’t be many complaints made against the balance sheet because of how strong it is. If you want to dive more into this on your own, please check out the attached spreadsheet above, or the SEC filings which I used in making the spreadsheet.152153154155156157158159160 147161162 The only question now is whether the price of the stock matches or is below the fair value of the company. I’m going to be using a DCF model with trailing twelve month (TTM) free cash flow (FCF) to evaluate the company because they are only just now turning EPS profitable, and EPS could show extreme percentage based growth due to how small the absolute size of the numbers currently are.

Below is my discounted cash flow model using TTM FCF. I’ve incorporated three different scenarios into the model and assigned them all probabilities in order to get a more comprehensive intrinsic value calculation. My estimation of intrinsic value is: $11.78.

There are many assumptions that I’ve built into my various scenarios, and I’m going to quickly walk through the three different scenarios and why I’ve assigned the values I did.

Generally, I’m taking the leadership at their word that, over a 5-ish year horizon, they will compound at a rate of 30%. I have this in my base case with variations of 5% to the positive and negative for my bull and bear case. Following this period of fast growth, I think relatively stable growth of roughly 15% will occur in Palantir for a decent amount of time. I incorporated this into the 5-11 year rates. While I understand this is still quite high relative to the broad market, I believe this to be a low-balled number for the company. They are effectively selling the picks and shovels to every company in the world that is interested in mining their data with AI. Their immense product capabilities, especially in conjunction with LLMs, leads me to believe that this figure builds in a margin of safety. Side note, the model has an 11 year time frame instead of 10 because I accidentally added an extra column and built the entire model before I realized, and it’s still being discounted so this shouldn’t affect the values.

Edit: I had an individual reach out to me and question why I would take leadership at their word for 30% growth over a 5 year time frame. This was a valid criticism. I tried to shorten the length and didn’t expand upon that point well enough; I’ll do so now. For one, Palantir had compounded grown at that rate since 2014 through when that statement was made. It has not been an unrealistic guesstimation in the past, and here is why I don’t think it will be going forward. First and foremost, there isn’t, as of yet, an issue of them having reached scale. They are still a relatively small company in the grand scheme of what market opportunities they have in front of them. Once that has been established, it’s up to each individual to determine whether their go-to-market (GTM) approach and product are sufficiently advanced enough to allow this to happen. The stunning success of AIP has certainly been inspiring, and looks to have real potential. Additionally, the ability for them to spin-off custom built solutions in order to address market segments, such as what they’ve done with FedSTART, points at their ability to gain additional growth and monetization without much additional product development. The potential ecosystem lock-in in combination with Foundry Marketplace also shows incredible potential for this to happen. Lastly, there have been many critics questioning their GTM approach, including analysts downgrading the stock due to this; however, I believe that this is just woefully ignorant. Alex Karp gave a highly sophisticated response to this question in his Bloomberg interview, and he said that the academic basis behind their GTM is that they believe their narrow segment of the AI market is going to have a Pareto distribution. I suggest readers research this concept because there is no way I could cover this within this article. However, if this ends up being the case, as I believe it will, Palantir will do unbelievably well. Within this article I have essentially laid out my entire arguement for why I agree with Karp’s assertion of their dominance over this niche, but absolutely critical, segment of the AI market, which will lead to the aforementioned Pareto distribution. These are the reasons why I am comfortable taking management at their word for 5-year revenue growth.